Beyond Bitcoin

Blockchain revolution in financial services

Beyond Bitcoin

Blockchain revolution in financial services

Blockchain technology is poised to transform the financial sector by increasing efficiency, transparency and security; reducing costs; and unleashing an unprecedented wave of innovation.

Blockchain, the technology behind the cryptocurrency Bitcoin, is one of the hottest topics in the financial sector. Dozens of large financial institutions, including many of the world's major banks, have already launched initiatives to explore blockchain's potential.

As applied in the Bitcoin context, blockchain is a decentralized, public ledger that contains the details of every Bitcoin transaction that has ever been completed. Due to a number of innovative technical protocols, the ledger has proven to be exceptionally accurate and secure.

Interest in the technology exploded when it became clear that blockchain can be used to document the transfer of any digital asset, record the ownership of physical and intellectual property, and establish rights through smart contracts, among other applications. By reordering and automating complex, labor-intensive processes, the technology can enable organizations to operate both faster and more cheaply.

Financial institutions are exploring a variety of opportunities to use blockchain, including applications to improve and enhance currency exchange, supply chain management, trade execution and settlement, remittance, peer-to-peer transfers, micropayments, asset registration, correspondent banking and regulatory reporting (including applications related to "know your customer" and anti-money-laundering rules).

Highlighting the potential for banks, Santander issued a report in 2015 estimating that blockchain "could reduce banks' infrastructure costs attributable to cross-border payments, securities trading and regulatory compliance by between US$15 – 20 billion per annum by 2022." And there is reason to believe the actual figure may be higher.

For most large financial institutions that are exploring blockchain opportunities, 2017 will be a year of continued innovation and experimentation. But these activities are only a prelude to profound changes throughout the financial sector.

ABCs of Blockchain

Blockchain is a technology that was initially developed for Bitcoin, the cryptocurrency. It is a distributed ledger or database that is operated by a peer-to-peer network of unaffiliated participants. Using computers running sophisticated algorithms, these participants, so-called Bitcoin "miners," process transactions according to strict protocols that ensure a very high degree of accuracy and security. Anyone can participate—the blockchain is fully transparent and available to all—but only the miners that are the first to process an individual transaction are compensated.

As individual transactions are processed and verified by other miners on the network, they are bundled into groups called blocks; blocks of transactions are linked together to make the blockchain.

Every Bitcoin transaction is permanently recorded in the Bitcoin blockchain for all to see, creating an ever-growing historic record of activity. The mining process creates continuous, decentralized monitoring by every computer on the network and ensures the accuracy and security of the blockchain record.

Blockchain technology revolutionizes the transaction process by dispersing control and providing total transparency, obviating the need for the type of middlemen or centralized authorities that traditionally conduct, authorize or verify transactions.

The use of blockchain is not limited to Bitcoin or other cryptocurrencies. Blockchain has the potential to transform how business and government work in a wide variety of contexts. Blockchain can be used to record and track the details of any transaction or ownership of any asset, including tangible assets such as real estate and intangible assets such as intellectual property. It can also be used to automate contracts, dramatically simplifying the process of creating and executing them. (Importantly, companies can choose to develop public or private blockchains, depending on their objectives; see the sidebar "Public vs. Private Blockchains" for more detail.)

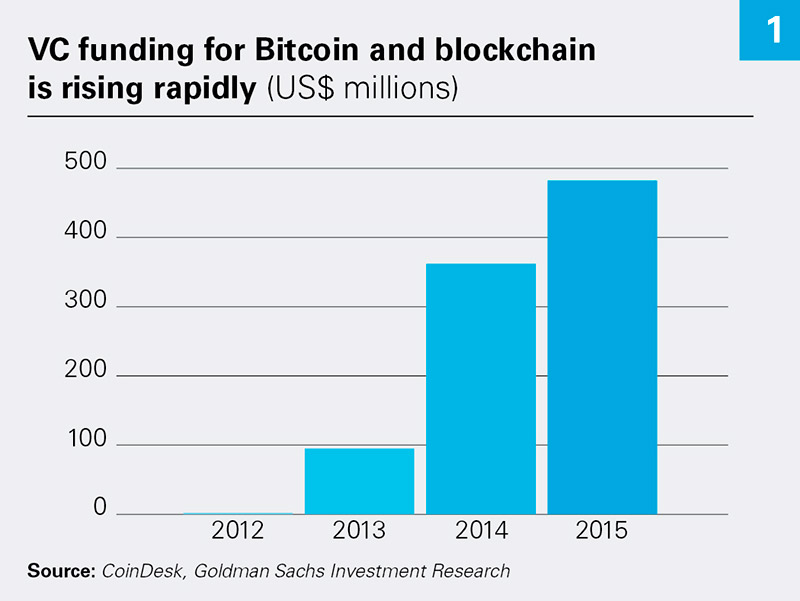

The perception of blockchain's potential is reflected in investment trends. According to Goldman Sachs, venture capital (VC) firms invested almost a billion dollars in the technology over the last three years, with about half of that amount invested in 2015 (Chart 1). As we will see, financial institutions are among the biggest investors in blockchain, reflecting a growing belief that the technology may actually have its greatest impact in the financial services sector.

Why choosing Our Platform?

Perfect Trade

Buy and sell with us

Trading with us is dead easy and fun. Wherever you are today, we have a consulting role to shape your future.

100% Secure

Safe system

All our services are most secure. All data are encrypted using the most reliable encryption technology. Your financial information is not disclosed to third parties.

Rapid Financial Growth

Grow with us

Our platform has the most growth potential. Join us to have active and regular passive income.

24 Hours Support

We always help

Our Support Team works 24 hours per day. We always help our partners and find the appropriate solutions.

Our Portfolio

Some of Our Recent Works

Suspendisse tempus sodales neque, eget eleifend turpis tristique eu. Nullam a nisl maximus, ultrices est ut blandit nislr, elit in lobortis mattis.